Qualified Business Deduction 2024 Calculator – Ready or not, the 2024 tax filing season is here. As of January 29, the IRS is accepting and processing tax returns for 2023. The agency expects more than 128 million returns to be filed before the . WealthUp Tip: Federal tax returns for the 2023 tax year are due April 15, 2024 to deduct up to 20% of their qualified business income.) Once you know your taxable income, calculate the .

Qualified Business Deduction 2024 Calculator

Source : www.hrblock.comFree Tax Calculators & Money Saving Tools 2023 2024 | TurboTax

Source : turbotax.intuit.comWe Hear a Lot About Inflation Rates, But Do You Know How It’s

Source : www.thewealthguardians.comGet Free Tax Help With AARP Foundation Tax Aide

Source : blog.aarp.orgIRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.orgCautious Optimism, But Most Investors Considering Low risk

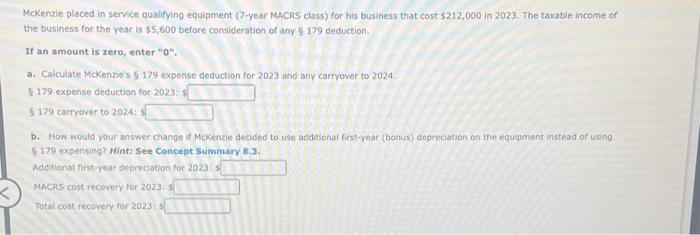

Source : www.luxuriousmagazine.comSolved McKenzie placed in service qualitying equipment | Chegg.com

Source : www.chegg.comAverage Tax Refund This Year Is $1,395: Why You Should File Your

Source : www.cnet.comSolved McKenzie placed in service qualifying equipment | Chegg.com

Source : www.chegg.comQualified Business Income Deduction and the Self Employed The

Source : www.cpajournal.comQualified Business Deduction 2024 Calculator Tax Calculator: Income Tax Return & Refund Estimator 2023 2024 : The expenses must be deducted in the year incurred. Oklahoma taxpayers may also deduct contributions to qualified 529 accounts. Those married filing jointly can deduct up to $20,000, while all . These deductions Business (SEP, SIMPLE, and Qualified Plans).” Internal Revenue Service. “Types of Retirement Plans.” Internal Revenue Service. “401(k) Limit Increases to $23,000 for 2024 .

]]>