Schedule A 2024 Form Federal – If your finances have been hit hard in recent months, the last thing you want to do is shell out more cash to file your taxes — which is already a dreaded experience for many. Fortunately, you may be . In 2021, the CTC was expanded after the passage of the American Rescue Plan. That year the tax was raised to $3,600 per child under the age of six, $3,000 per child between ages 6 to 17, and it was .

Schedule A 2024 Form Federal

Source : www.amazon.comFederal Student Aid

Source : www.facebook.comAmazon.com: 2023 2024 Monthly Planner: 2 Years Large Calendar form

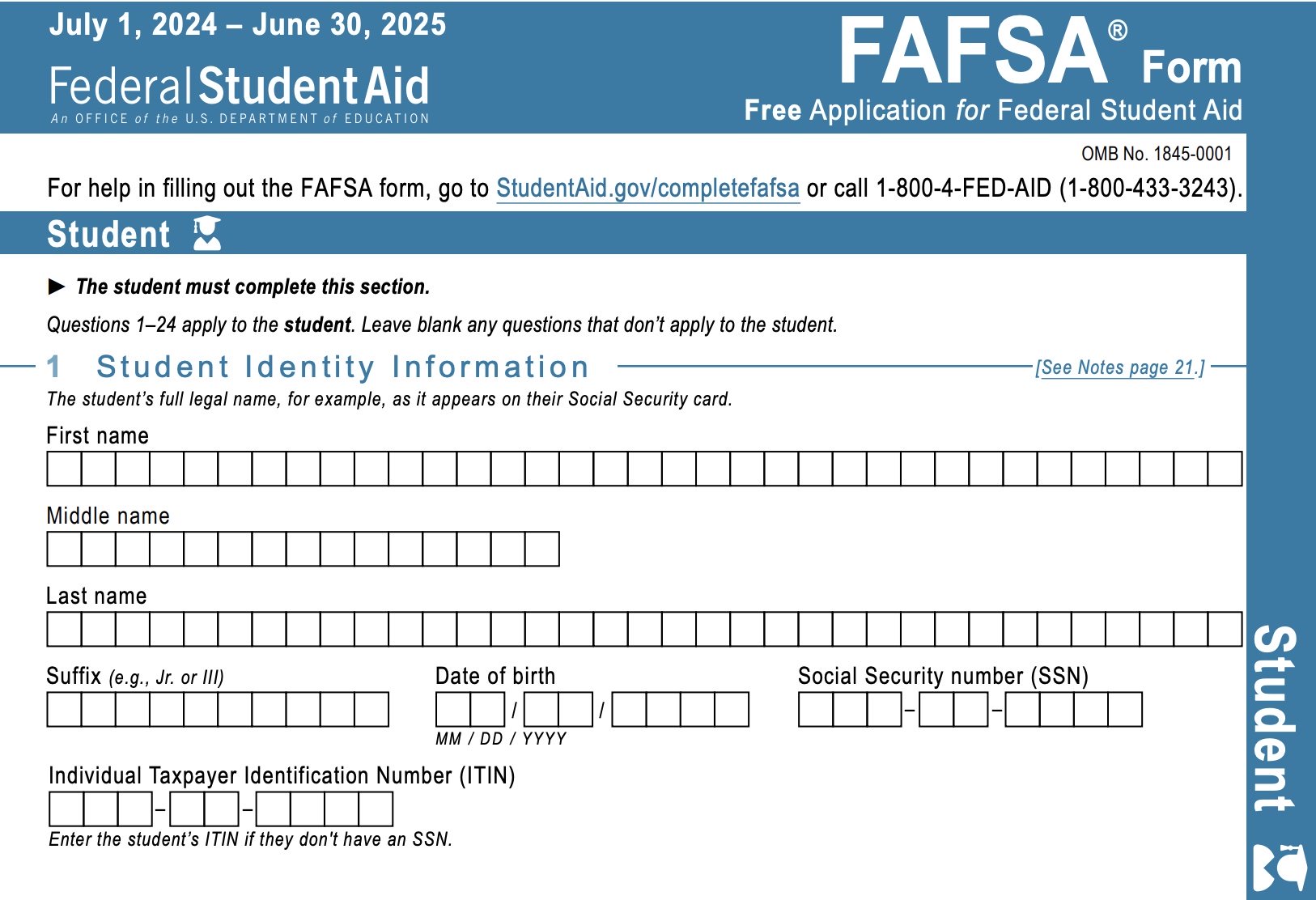

Source : www.amazon.com6 Things Students Need Before They Fill Out the 2024–25 FAFSA

Source : studentaid.govAmazon.com: 2023 2024 Monthly Planner: Large Two Years Calendar

Source : www.amazon.comFederal Tax Filing Deadlines for 2024 420 CPA

Source : 420cpa.comIRS Releases 2024 Form W 4R | Wolters Kluwer

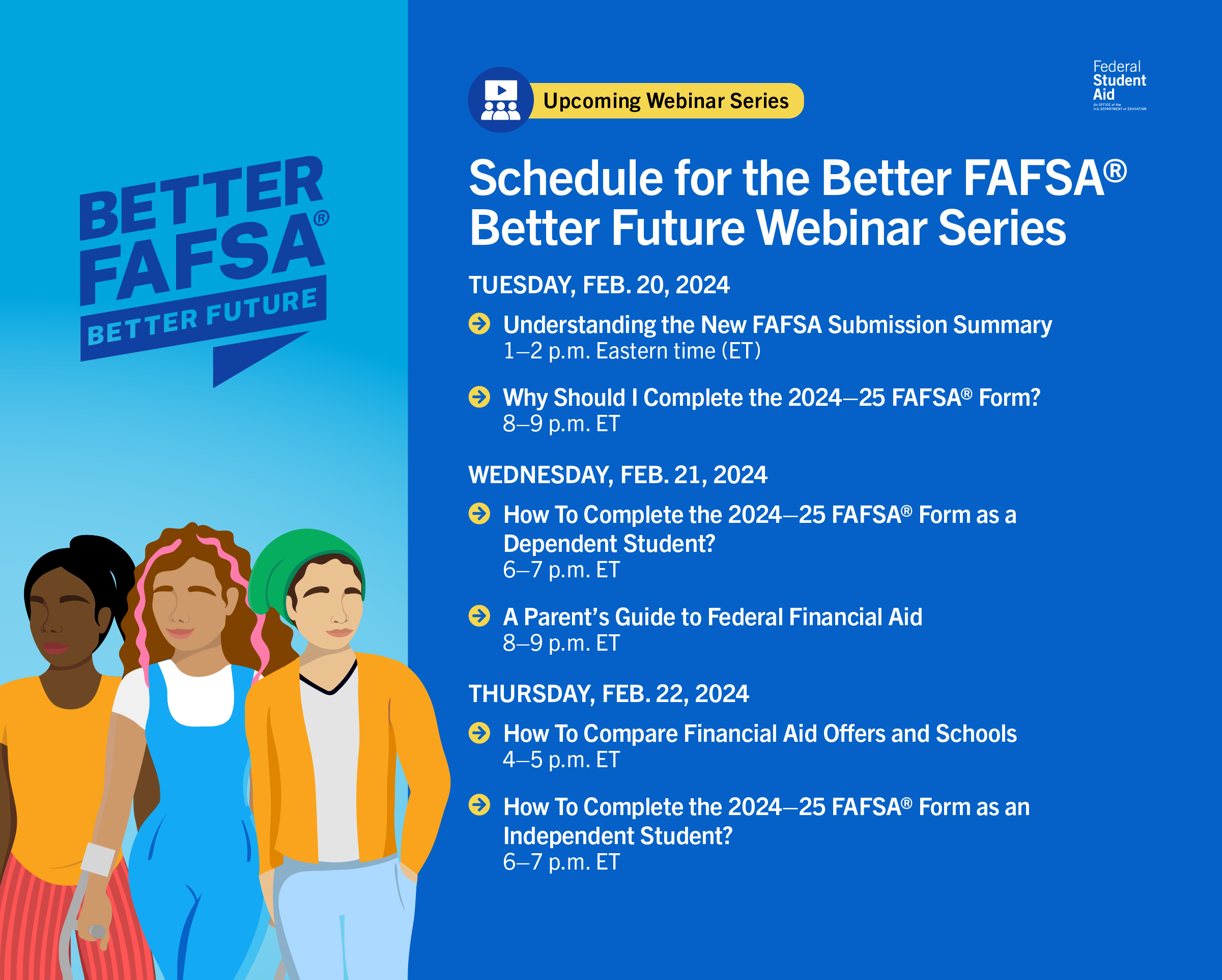

Source : www.wolterskluwer.comFederal Student Aid (@FAFSA) / X

Source : twitter.comFree FAFSA on the Web 2024 Free Application for Federal Student Aid

Source : www.college-financial-aid-advice.comIRS Delays Implementation of 1099 K Filing Changes to Calendar

Source : taxschool.illinois.eduSchedule A 2024 Form Federal Amazon.com: 2023 2024 Monthly Planner: Large Two Years Calendar : These qualified tuition plans allow federal tax-free withdrawal of earnings and the Internal Revenue Service. “Instructions for Form 709 (2019) Schedule A. Computation of Taxable Gifts: Line B. . The easiest way to claim a home-office tax break is by using the standard home-office deduction, which is based on $5 per square foot used for business up to 300 square feet. The “regular method” for .

]]>